Gift Tax Deduction 2025. The tax applies whether or not the. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. Gift and gst tax annual exclusion amount:

Things you should know about the Federal gift tax in USA Advisory, For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. This means that you can give up to $18,000 to anyone without having to worry about paying any gift tax.

Do you need to file gift tax returns? Hobe & Lucas, Gift tax, generation skipping transfer tax, and estate tax exemptions (unified) single: In 2025, the estate and gift tax exemptions will increase again, with the amount of the increate dependent on the level of inflation during 2025.

Estate Tax Exemption and Annual Gift Tax Exclusion for 2025 Scott, The lifetime exemption is the value of gifts you can give to others during your lifetime before you are subjected to gift taxation. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted.

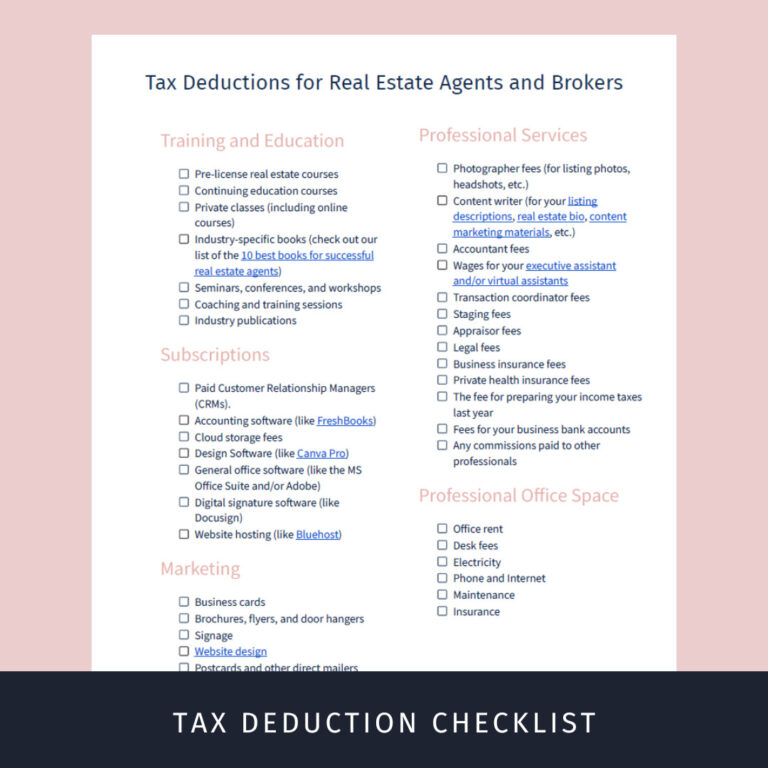

Free Gift Tax Deduction Checklist Key Real Estate ResourcesKey Real, The lifetime exemption is the value of gifts you can give to others during your lifetime before you are subjected to gift taxation. For example, a man could give $18,000.

How To Avoid Gift Tax Legally In 2025 Money Market Insights, Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient. The faqs on this page provide details on how tax reform affects estate and gift tax.

Use the 2016 Gift Tax Exclusion to Beat the Estate Tax The Motley Fool, Gift tax rates range from. The irs tax adjustments for tax year 2025 updates the exemptions and exclusions for estate and gift tax for non us persons (greencard holders and nra’s).

Lifetime Gift Tax Exemption 2025 All you need to know about it is here, Find some of the more common questions dealing with basic. It is a transfer tax, not an income tax.

Tax Prep Checklist Tracker Printable Tax Prep 2025 Tax Etsy UK, Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which was $12.92 million in 2025 and $13.61 million in 2025. The exemption figure covers both.

Example tax deduction system for a single glutenfree (GF) item and, The exemption figure covers both. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Annual gift tax exclusion amount increases for 2025 Merline & Meacham, PA, The gift tax limit (or annual gift tax exclusion) for 2025 is $17,000 per recipient. You need not be concerned.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient.